Voyage Manager Simplifies Global Tax Compliance for Travelling Employees

Voyage Manager can help limit your international tax exposure by keeping track of days spent in country, and warning you of relevant thresholds. It can also warn you of the potential tax consequences of travel across your whole organisation.

Days in Jurisdictions

We monitor and report on the number of days people spend in countries and states

Audit Trail

Using many data sources we provide a detailed audit trail of where people have been.

Permanent Establishment

We monitor and report on the accumulate days in jurisdictions across your organisation

Voyage Manager’s Solution to Tax Compliance Challenges

Frequent travel creates daunting tax compliance challenges. Every country has its own rules, and these often change. Brief repeat trips may render staff liable for taxes or social security contributions. Your organisation's total travel patterns may breach permanent establishment thresholds. Many companies struggle to track the frequency, length and purpose of employee travel. And yet, should a dispute arise, the burden of proof will fall on the organisation's shoulders..

Voyage Manager is here to help you minimise your international tax exposure. Our robust system tracks exactly how long your employees spend in different countries. It will alert you to approaching thresholds. It will also provide a unified view of travel across your whole organisation.

Voyage Manager enables you to effortlessly prove your tax compliance. It creates an audit trail showing exactly how long your staff spent in each country or state. Your tax adviser can use these records to draw on bilateral treaties to avoid double taxation.

How Voyage Manager Tracks Employee Locations

Our tax tool incorporates our industry-leading travel tracker. It tracks your staff using:

- Travel reservation and booking data

- Mobile device polling

- GPS tracking of smartphones and dedicated hardware devices

- Card transaction and expense data

- Manual input from travellers

Key Features of Our Tax Tool

Our robust and versatile tax tool:

- Provides an accurate picture of travel-related tax exposure.

- Maintains a verified audit trail of days in country.

- Offers state-by-state reporting of interstate travel within the USA.

- Warns employees in advance of approaching tax thresholds.

- Includes a permanent establishment (PE) calendar and calculator, letting you easily track the presence of all your employees in every relevant country per day.

- Serves as a lasting record of all your organisation’s travel.

- Works in the background 24/7

Your staff will be able to:

- Access their personal tax residency data from anywhere

- Update their travel plans

- Check the number of days spent in a country or state, and how many they have left

- Specify work and non-work days in the context of a longer trip. (Some jurisdictions apply different tax rules to holidays.)

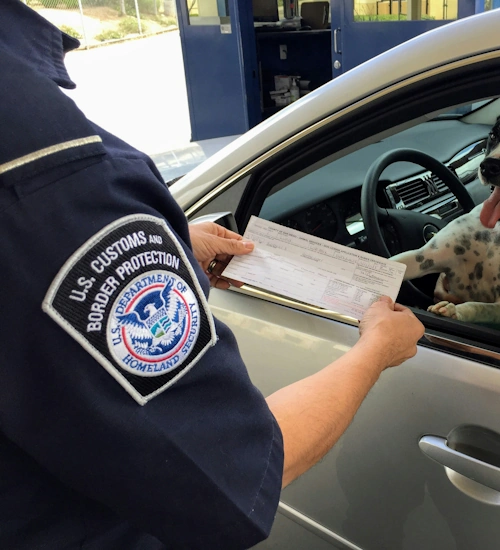

Voyage Manager Mitigates Immigration Risks Too

Tax and immigration issues go hand in hand, although the rules applicable to each differ. Voyage Manager also includes a comprehensive immigration compliance tool. It makes use of the same location data to ensure travellers do not breach visa or visa waiver conditions. Like our tax tool, it works both at a personal level and across the organisation.

Transform Your Tax Compliance Process with Voyage Manager

Don’t let the complexities of global tax compliance endanger your business. Book a demo today to find out how Voyage Manager can save you time while reducing your tax exposure risk.

Contact Us Or Book A Demo

We would love to be able to tell you all about Voyage Manager, and answer your questions. Contact us by phone or email to find out more or book a demo. We look forward to working with you.