The Tax Implication of Travel

Travel can have significant tax implications for both individuals and organisations. Proper management and monitoring of travel activities is essential for ensuring compliance and minimising risk.

What are the tax implications of travel?

Every country has its own tax residency rules, which can be anything from 60 days to no limit at all. For a large number of countries like to OECD countries the limit is 183 days. Once you have been in the country for beyond the limit within a tax year you may be automatically considered resident for tax purposes.

Knowing, and being able to document, how many days you have spent in a country is therefore essential for frequent travellers. Spending too many days in any one country may lead to tax and social security obligations in multiple countries.

Travellers and employers can save significant amounts of money by monitoring the amount of time travellers spend within a country, and ensuring that the traveller departs before going over those countries' thresholds.

How Voyage Manager Can Help You

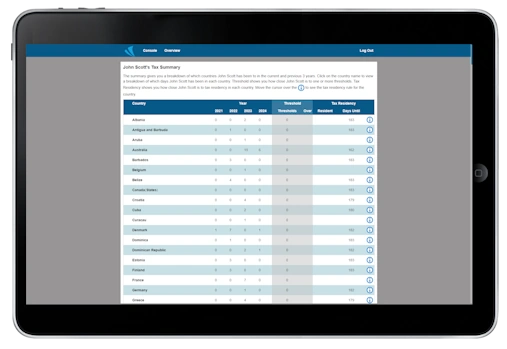

We continuously monitor the number of days employees spend in each country or state and notify you and the employee as they approach and breach company and government thresholds. We also provide detailed reports on how many days and which days are spent in the states and countries for up to 5 years.

Find Out More About Travel And Tax

Contact Voyage Manager to discover how our platform can simplify tax compliance and risk management.

Book a demo or contact us for more information.