Tracking Tax For PAs, CEOs And C-Suite

Accurately tracking travel days for CEOs, C-suite executives and high-profile employees is crucial for tax, immigration and compliance. Traditional methods are error-prone and time-consuming – but there’s a better way.

Are you responsible for your boss' travel?

As a personal or executive assistant you are likely to be responsible for all aspects of your boss' or team's travel, from planning and booking to security, expenses and tax accounting.

If you are then read on...

Tax Implication of Travel

When spending a significant amount of time in any country or state a traveller risks tax and residency issues. It is essential that you monitor and record how many days are spent in each location. Failure to meet ones tax obligations can result in fines, delays, bans and potentially prison.

How Voyage Manager Can Help You

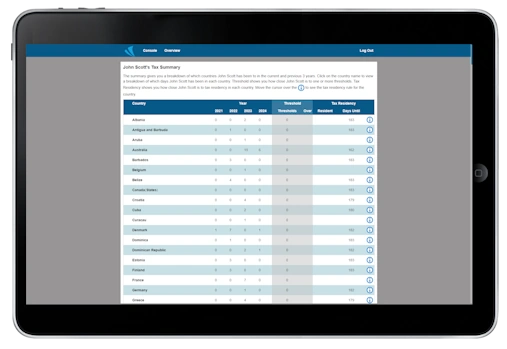

Voyage Manager makes it easy to manage traveller's trips and days in country. Upload your trips to our service and we will do the rest. We monitor the trips from the moment they are entered until the are completed, giving you a clear picture of where they are, have been and will be.

When the traveller approaches residency thresholds we will automatically notify you by email, allowing you to take appropriate action.

We also monitor visas and passport ensuring that you are notified before the documents expire. Our visa partners can help you with the visa application process, taking another workload off your mind.

Find Out More About Travel And Tax

Contact Voyage Manager to discover how our platform can simplify tax compliance and risk management.

Book a demo or contact us for more information.